Merchant services providers are notorious for claiming that they can beat your rates. “It doesn’t matter who your current provider is,” they say in a cold sales call to your business, “we guarantee that we can beat their rates and save your business money!” Sometimes they can, but sometimes they use dubious pricing schemes to make their rates appear lower when they may actually be higher than others.

There are four common pricing models used by merchant services providers in the industry, and some are more transparent than others. Smart business owners will analyze which pricing model their prospective merchant services provider uses, not just their rate, when making a decision to sign-on. Read more to learn what these pricing models are and which might work best for your business!

Hint: At Cornerstone Credit Services, we use the interchange-plus pricing model, the most transparent and recommended industry-wide! Learn more about what we’re doing to beat national credit card processing rates for local, Anchorage business owners.

Pricing Models

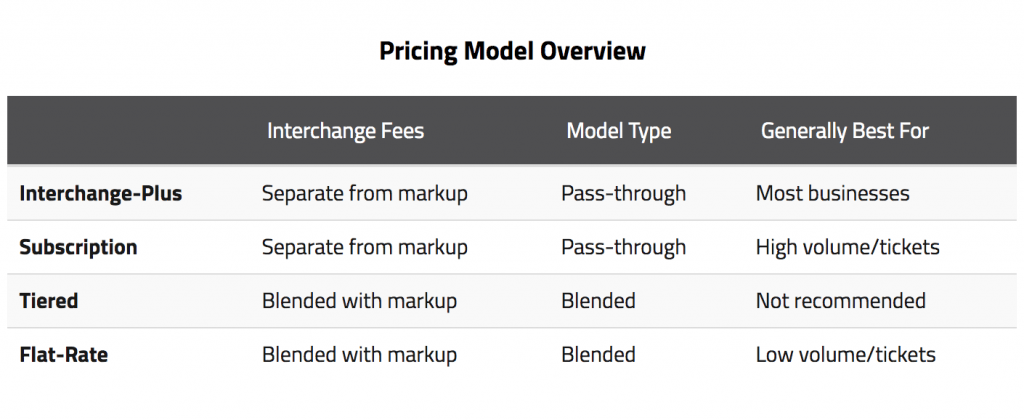

The four common pricing models fall into one of two categories, pass-through or blended. Pass-through pricing models keep interchange fees, the fees set by the card associations, and markup fees, the fees set by your merchant service provider, separate. For more information on these types of fees, read our blog An Introduction to Credit Card Processing Fees. By keeping the fees separate, pass-through pricing models allow you (the business owner) to see what your merchant services provider’s markup rate really is. Blended pricing models hide the rate in the interchange fees.

Although blended pricing models are less transparent, they can be appropriate for businesses that are processing a low volume of transactions. See the table below published by Merchant Maverick for a direct comparison of the four pricing models and which types of businesses they work best for.

Interchange-Plus

Pass-Through

As we mentioned in the “hint” above, interchange-plus is the most transparent pricing model in the industry and is recommended for most businesses. A pass-through pricing model, interchange-plus keeps interchange fees and your merchant services provider’s markup fees separate. If you are partnered with a provider who uses interchange-plus, your statements will show you a line-by-line itemization of the individual interchange and markup fees your business incurred on a per-transaction basis. These statements can be hard to reconcile, but business owners who are willing to read through and analyze them will have a better understanding of where their money is going than those who receive blended statements. The markup percentage applied in the interchange pricing model stays the same per-transaction regardless of the kind of card you accepted and how you processed it.

Subscription

Pass-Through

The subscription pricing model is becoming popular because it can save a lot of money for businesses processing a high volume of transactions. With the subscription model, businesses are charged a flat monthly rate in addition to a per-transaction fee. Subscription pricing is a pass-through model as well, keeping interchange and markup fees separate.

Tiered

Blended

At first glance, a tiered pricing model appears to be the easiest to understand. This could not be further from the truth. Tiered pricing models are blended, meaning, the interchange fees and markup fees are included together in the rate provided. This makes it impossible for a business owner to distinguish what the merchant services provider’s markup fees truly are. Tiered pricing models also place businesses into categories (tiers), such as qualified, mid-qualified, and non-qualified, changing their rates based on which tier the business falls into. Unfortunately, merchant services providers who use tiers often do not disclose to their clients which tier they are in, if they are being charged more than other clients. Sadly, many business owners have fallen into the trap of tiered pricing schemes which are not recommended.

Flat-Rate

Blended

Although blended, a flat-rate pricing model can be beneficial for businesses that are processing a low volume of transactions. This model does not include a monthly fee and maintains consistent percentage and per-transaction fees. Talk to a merchant services professional about which pricing model might be best for your business.

Next time a merchant services provider tells you, “We guarantee we can beat your rates!” Ask them, “Which pricing model do you use?” The pricing model a provider chooses to use will give you genuine insight into the fairness of their rates. At Cornerstone Credit Services, we use an interchange-plus pricing model. If you are interested in learning more about our pricing model and rates, drop us a line! We would love to help you compare rates and find the best merchant services provider for your business.